Moving to a new home is an exciting adventure, but it can also be a stressful one. There are countless details to consider, from packing up your belongings to coordinating with a moving company. Amidst all this, it’s crucial not to overlook one aspect of the moving process: insurance. Specifically, you should know what is a Certificate of Insurance for moving is and why it matters when planning a move.

What is a Certificate of Insurance (COI)?

A Certificate of Insurance (COI) is a vital document within the realm of building management, particularly for building management companies. It serves as a concise but crucial snapshot of an individual or entity’s insurance coverage, detailing key aspects such as the types and amounts of coverage, insurance policy limits, and the effective dates of the policies. Building management companies often require tenants, contractors, or vendors to furnish a COI as proof of adequate insurance protection. This practice ensures that in the event of unforeseen incidents or liabilities, the responsible party has sufficient coverage to mitigate potential risks and liabilities, thereby safeguarding the interests of both the building management and the parties involved.

Components of a COI

A typical COI consists of several key components:

- Insured Party’s Information: This includes your name or the name of your business property managers, depending on who is moving.

- Insurance Company Details: Information about the insurance company providing the coverage.

- Policy Number and Effective Dates: These details specify the policy’s identification number and the period during which it is valid.

- Types of Coverage: A breakdown of the specific types of coverage provided by the insurance policy.

Why Do You Need a COI for Your Move?

Protecting Your Belongings

When you move, your belongings are exposed to various risks, such as damage during transit or accidents during loading and unloading. A COI helps safeguard your possessions by ensuring an insurance safety net.

Moving companies are generally careful with your items, but accidents can happen. If a mishap occurs, having a COI in place means that you have a financial safety net to cover the cost of repairs or replacements.

Liability Coverage

Liability coverage is another critical aspect of a COI. It protects in case you or the Abbotsford moving company are held responsible for any damage or injuries during the move from an apartment building or luxury building. This can include damage to your property, injuries to movers, or damage to third-party property.

Without liability coverage, you could be personally liable for these expenses, which can be substantial. Having a COI with liability coverage ensures you’re not left with a hefty bill in case of an accident.

Vendor Requirements

Many reputable moving companies require their clients to provide a COI. This is not just a way for them to protect themselves; it’s also a sign of a trustworthy moving company. Companies that ask for a COI are demonstrating their commitment to professionalism and accountability.

How to Obtain a Certificate of Insurance

Contacting Your Insurance Provider

Obtaining a COI starts with your insurance provider. Here’s how to go about it:

- Contact Your Insurance Agent: Contact your insurance agent or customer service representative.

- Request a Certificate of Insurance: Clearly state your request for a COI and specify that it’s for your upcoming move.

- Provide Necessary Information: Be prepared to provide information such as your policy number, the date of your move, certification of insurance, official document, and the name of your moving company.

Working with Your Moving Company

Once you have the COI from your insurance provider, you’ll need to work with your chosen moving company to ensure everything is for the entire process:

- Share the COI: Send a copy of the COI to your moving company well in advance of your moving date.

- Confirm Receipt: Follow up with the moving company to confirm that they’ve received and accepted the COI.

- Clarify Any Concerns: If your moving company has any questions or concerns about the COI, address them promptly to avoid any last-minute issues.

Tips for Reviewing a Certificate of Insurance

Ensuring Adequate Coverage

While having a COI is essential, ensuring adequate coverage and insurance confirmation for your move is equally important in the relocation process. Here are some tips:

- Review Coverage Types: Understand the types of coverage provided by your COI, such as property damage, liability, and injury coverage.

- Assess Coverage Limits: Check the coverage limits to ensure they match the value of your possessions and potential liabilities.

- Additional Riders: Inquire about adding other riders or endorsements if needed.

Validity and Expiration

A COI is only applicable if it’s valid and up-to-date:

- Check Validity Dates: Verify that the COI is good for the entire duration of your move.

- Monitor Expiration Dates: Keep an eye on the COI’s expiration date and renew it if necessary to avoid coverage gaps.

Understanding the Fine Print

The terms and conditions of a COI can have a significant impact on your coverage and in your moving experience:

- Read Carefully: Take the time to read and understand the fine print of the COI.

- Ask Questions: If there are clauses or terms you don’t understand, don’t hesitate to ask your insurance provider for clarification.

Conclusion

In the hustle and bustle of planning a move, it’s easy to overlook the importance of insurance. However, a Certificate of Insurance (COI) is vital to provide peace of mind during this significant life change. By understanding what a COI is, why you need it, and how to obtain one, you can ensure that your move goes smoothly and your valuable belongings are well-protected by professional movers.

Remember to review your COI carefully, keep it up-to-date, and don’t hesitate to ask your insurance provider for guidance if needed. With the right COI in place, you can confidently embark on your moving journey, knowing you’ve taken steps to protect what matters most.

Trust Gorilla Moves for Your Peace of Mind!

Have questions about a Certificate of Insurance for Moving and why it matters? Let Gorilla Moves be your guide! We’re experts in ensuring your belongings are protected during your move. Contact us today to learn about our services and how we can provide you with the peace of mind you deserve.

FAQs: What is a certificate of insurance for Moving?

What is a Certificate of Insurance for Moving?

A Certificate of Insurance for Moving is a document that provides proof of insurance coverage held by a moving company. It typically includes details about the insurance policies, such as liability coverage and cargo insurance, held by the moving company to protect your belongings during the move.

Why do I need a Certificate of Insurance when hiring a moving company?

A Certificate of Insurance is essential because it verifies that the moving company has adequate insurance coverage. It assures you that your belongings are protected in case of damage, loss, or accidents during the moving process. Many landlords and building managers may also require this certificate before allowing a moving company to operate.

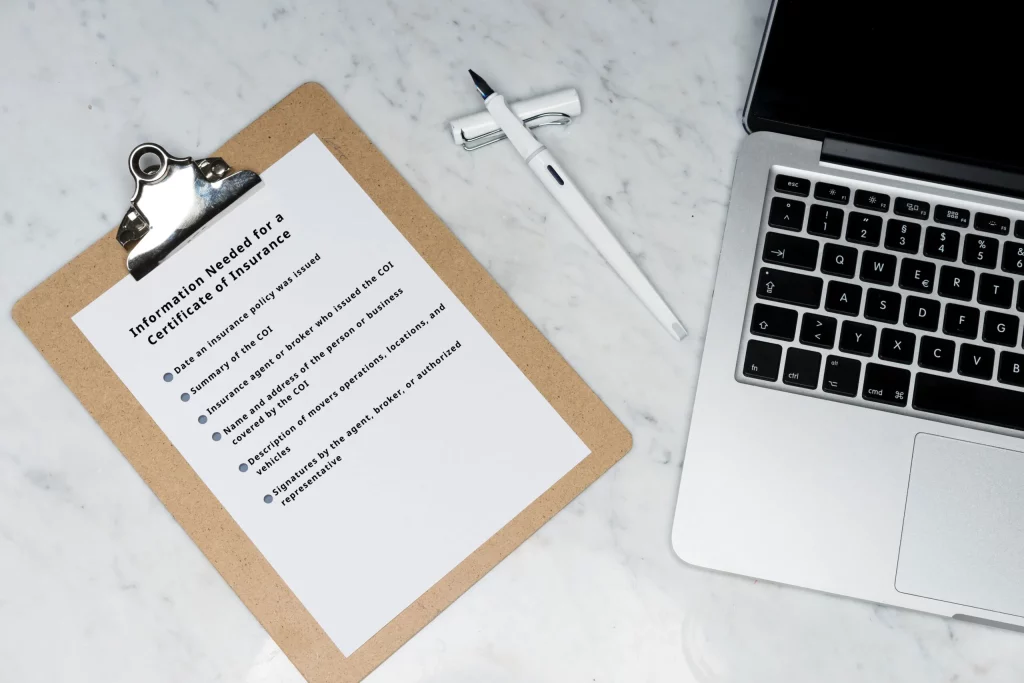

What information is typically included in a Certificate of Insurance for Moving?

A Certificate of Insurance typically includes the moving company’s name, the types and limits of insurance coverage they hold, the effective dates of the policies, and the name of the insurance provider. It may also specify whether the certificate holder (you, the customer) is additionally insured.

How can I verify the authenticity of a Certificate of Insurance provided by a moving company?

You can verify the authenticity of a Certificate of Insurance by contacting the insurance provider directly. Ensure that the information on the certificate matches the details provided by the insurance company. This step is essential to confirm that the moving company’s insurance is valid and current.

Is a Certificate of Insurance for Moving the same as a Bill of Lading?

No, a Certificate of Insurance and a Bill of Lading are different documents. A Certificate of Insurance provides proof of the moving company’s insurance coverage, while a Bill of Lading is a contract between you and the moving company that outlines the terms and conditions of the move, including the inventory of items being transported, delivery dates, and payment details. Both documents are important when hiring a moving company for your relocation.